0 R Squared

The definition of R-squared is fairly straight-forward; it is the percentage of the response variable variation that is explained by a linear model. Or: R-squared = Explained variation / Total variation. R-squared is always between 0 and 100%: 0% indicates that the model explains none of the variability of the response data around its mean. R-squared value always lies between 0 and 1. A higher R-squared value indicates a higher amount of variability being explained by our model and vice-versa. If we had a really low RSS value, it would mean that the regression line was very close to the actual points. R-squared values range from 0 to 1 and are commonly stated as percentages from 0% to 100%. An R-squared of 100% means that all movements of a security (or another dependent variable) are completely.

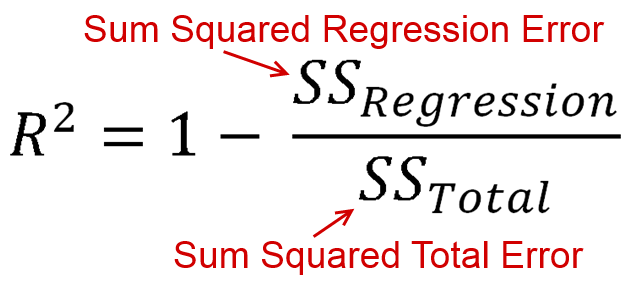

0 R Squared Equation

R-squared.

0 R Squared Formula

R-squared is a statistical measurement that determines the proportion of a security's return, or the return on a specific portfolio of securities, that can be explained by variations in the stock market, as measured by a benchmark index.

0 R Squared

For example, an r-squared of 0.08 shows that 80% of a security's return is the result of changes in the market -- specifically that 80% of its gains are due to market gains and 80% of its losses are due to market losses. The other 20% are the result of factors particular to the security itself.